eNews – June 2018

In this newsletter, we begin by providing you with information relating to the rules for accessing certain sources of income in retirement. Our animation illustrates the finer details of the Downsizing Measure. We explore personal insurances and the risk probability/impact matrix. We look at the relationship between saving motives and saving habits. And, Hamish and Andy provide a funny video, which serves as a good metaphor for the old proverb, ‘If it seems too good to be true, it probably is’.

Retirement age? Accessing sources of income

For many of us, retirement age (and how we intend to fund our retirement lifestyle) is often guided by the rules relating to the accessibility of certain sources of income, for example, superannuation and the Age Pension. In this article, we discuss these rules in further detail.

Downsizing measure

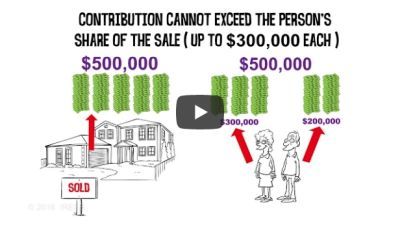

From 1 July 2018, those aged 65 or over will be able to use the proceeds from the sale of their home, to make a downsizer contribution of up to $300,000 each into superannuation (subject to complying with some finer details). In this animation, we take an in-depth look into the Downsizing Measure.

Personal insurances: The risk probability/impact matrix

Insurance, in general, can sometimes be seen as a ‘grudge purchase’ as there can be a perception of little tangible value (until claim time). In this article, we explore the risk probability/impact matrix to highlight the value of personal insurances when it comes to managing certain lifetime risks.

The relationship between saving motives & habits

When it comes to saving habits, there are often three camps, regular savers, irregular savers and non-savers. Invariably, there is a relationship between saving motives and saving habits; however, external factors can sometimes be a disruptive force. In this article, we explore this relationship further.

Scams: If it seems too good to be true, it probably is…

Have you ever been in a situation where you had a personal or work deadline and instead of sticking to your schedule you got side-tracked? For some people procrastination can also play a part in how they approach their personal finances. We hope you enjoy this funny and insightful talk.